premium loan life insurance

What is premium financing. Navigating the options available and.

Premium Financing Life Insurance The Insurance Pro Blog

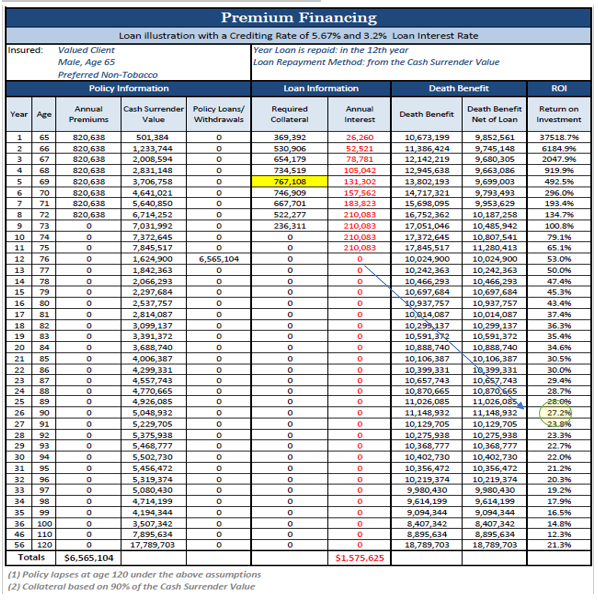

They borrow the 100000 at 5 interest resulting in an out-of-pocket interest expense of.

. Life insurance premium finance loans are made annually on the policy anniversary when premiums are due. Lower Premiums and Higher Discounts on taking life insurance early. For example a client is purchasing a policy with a premium of 100000 per year.

Premiums of Home Loan Insurance depends on three main categories that include age of the insured or borrower loan. Typically a life insurance policy may be reinstated within a 15-day period without any additional paperwork or a medical examinationThe policyholder may be. A few of our representative transactions are listed below.

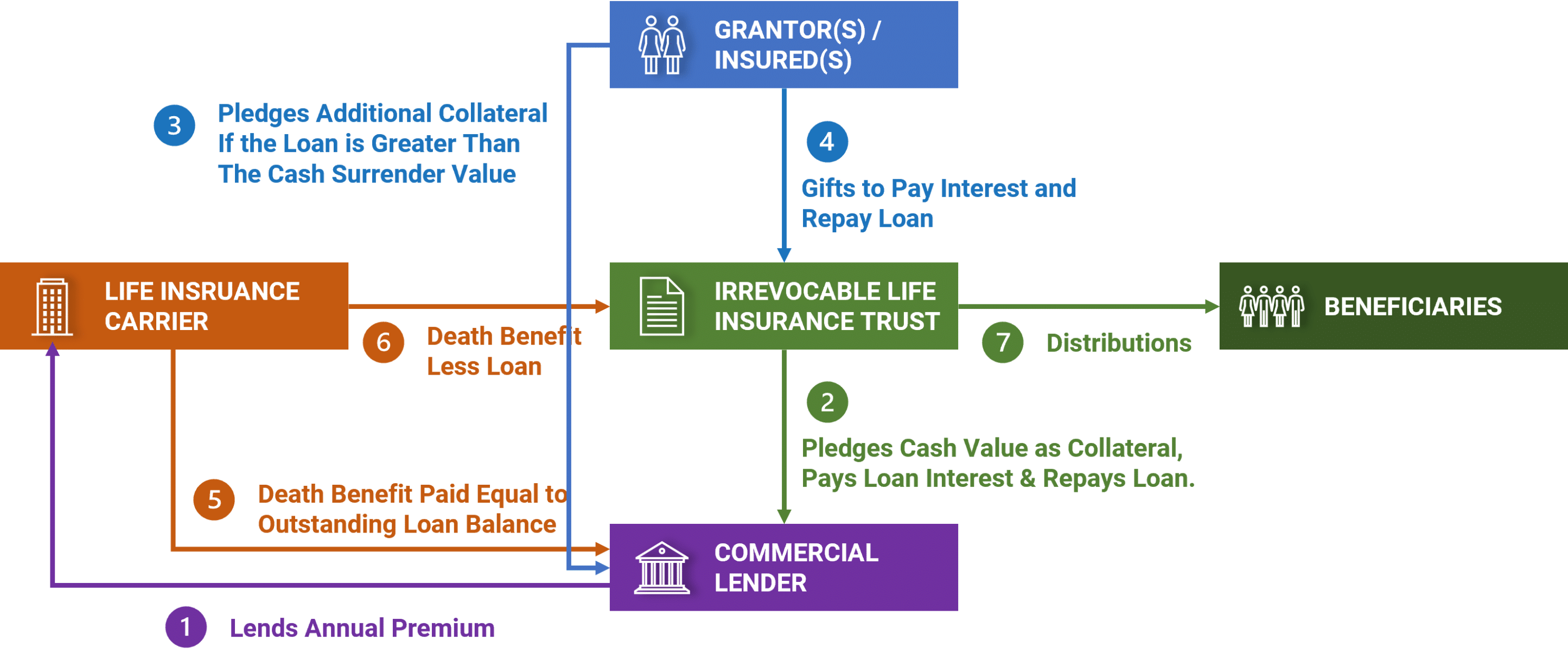

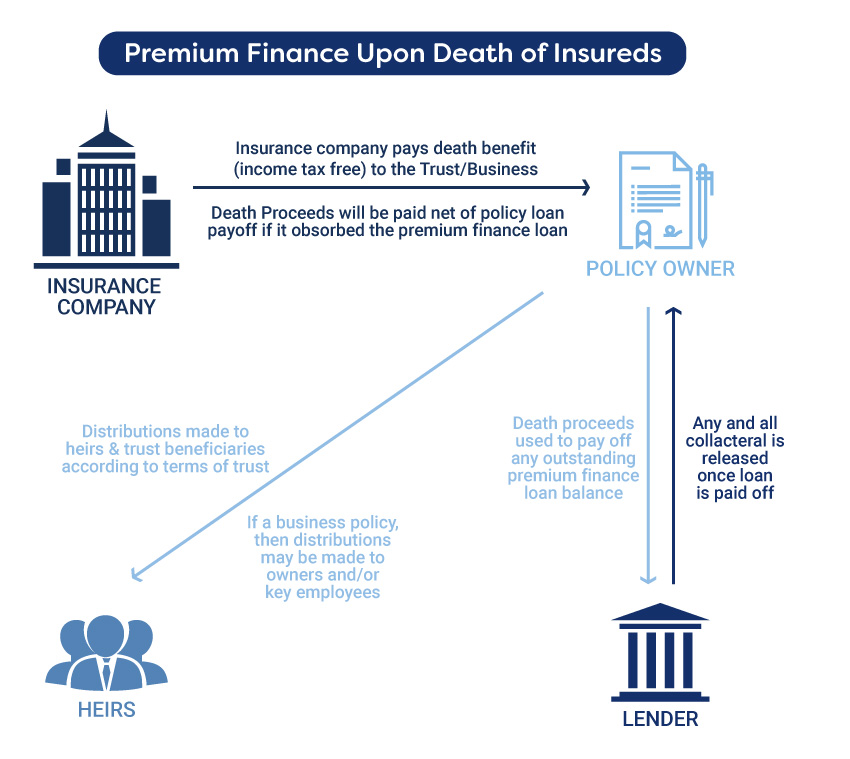

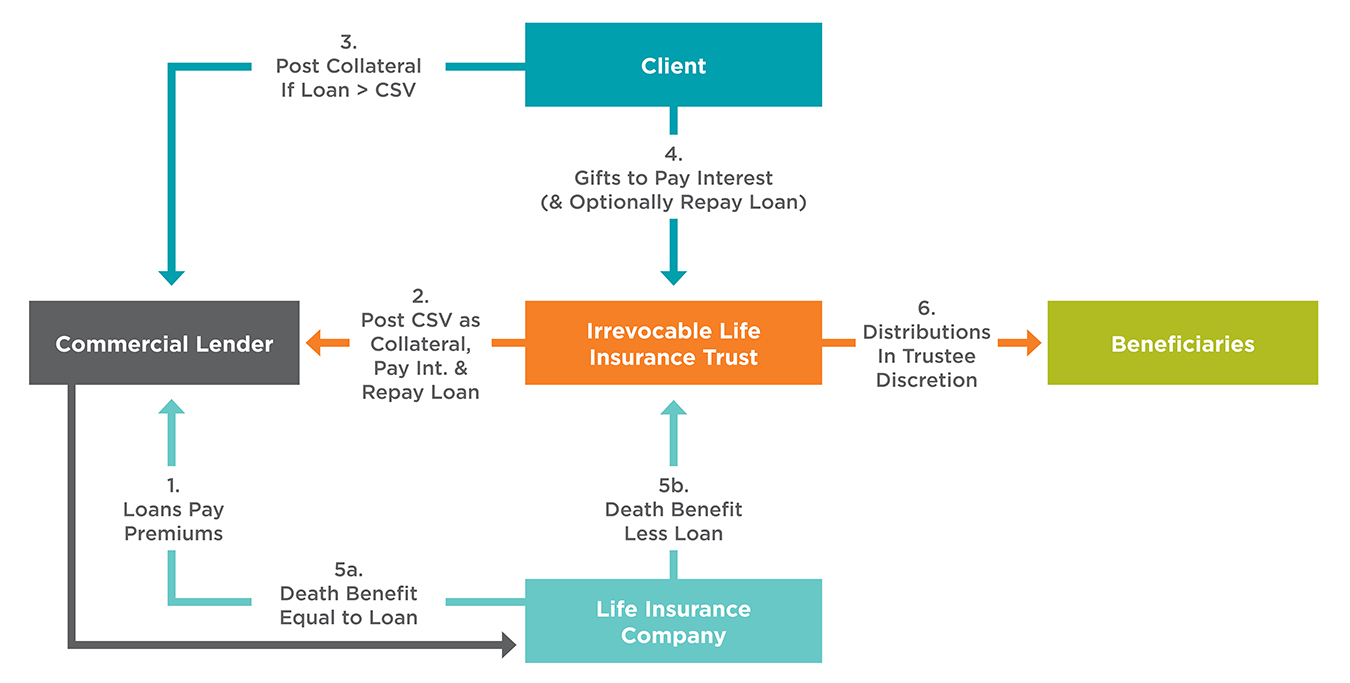

The clause minimizes the risk of an insurance policy becoming lapsed due to. Premium financing is often used when a life insurance policy is owned by an entityfor example an irrevocable life insurance trust ILITwhich may not have enough cash or assets to make. Premium financing is the lending of funds to a person or company to cover the cost of an insurance premium.

Premium insurance financing enables high net worth individuals HNWI to obtain life insurance at minimal cost by arranging financing from a lender to cover. Basically the clause means that the insurance company. The automatic premium loan is usually an optional clause of the life insurance policies.

This percentage considers your credit score and. The automatic premium loan clause is a clause that is commonly found in cash value life insurance policies. Cost-effective process to obtain life insurance coverage with reduced out of pocket costs in most cases.

The carried-over 1600000 in cash value and an additional 700000 financed by a bank specializing in premium financing. Premium finance loans are often provided by a third party finance entity. The annual deductible for all Medicare Part B beneficiaries is.

Generally a lender allows you to borrow 50 to 90 percent of the cash value when you collateralize your life insurance policy. The standard monthly premium for Medicare Part B enrollees will be 16490 for 2023 a decrease of 520 from 17010 in 2022. Keep money in high-returning asset classes.

So even though younger people tend to have higher incomes than older people doand therefore make. 15-30 days or less. The funding for the new policy was in two parts.

Categorization of Home Loan Insurance Premium. Minimize gift and estate. We also serve as counsel to lenders in refinancings of existing life insurance premium loan facilities.

Understanding the Life Insurance Premium Finance Loan. In todays rising interest environment premium financing remains a viable strategy for qualified clients to purchase large life insurance policies.

For Financial Professional Use Only Not To Be Used With The Public Insurance Products Are Issued By John Hancock Life Insurance Company U S A Boston Ppt Download

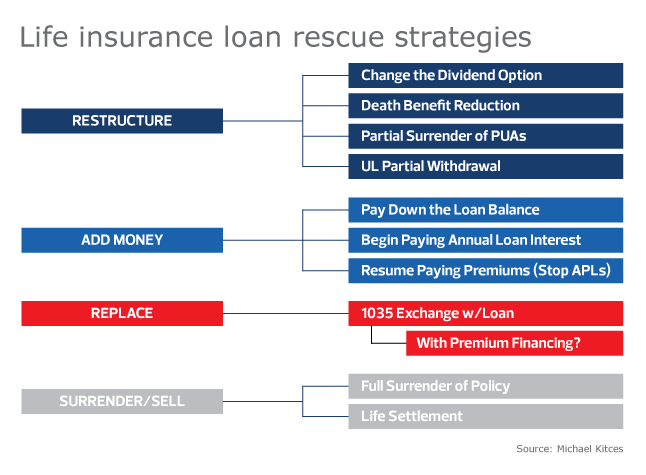

Kitces When A Life Insurance Policy Sends An Sos Financial Planning

Premium Financing Life Insurance

Leveraging Life Insurance A Guide To Premium Finance

Solved 3 Life Insurance Operations Use The Following Table Chegg Com

All About Premium Financing Singapore Financial Planning

Premium Financing Life Insurance Learn More Ltcadv

Premium Financing Life Marketers

Application Form For Life Insurance

Premium Financing Wintrust Life Finance

Premium Finance Emp Financial Network Inc

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Best Practices Financing Life Insurance Premiums

Mortgage Life Insurance 7 Essential Facts And Pros Cons

Life Insurance Policy Loans Tax Rules And Risks

Best Indexed Universal Life Insurance How Does Iul Work

Premium Financing Life Insurance What Can Go Wrong Agency One